HARTFORD, Conn.–(BUSINESS WIRE)–Many couples will be basking in the glow of getting engaged this Valentine’s Day, and Travelers wants to help protect them from potential wedding day problems. The company today released its most common causes for wedding insurance claims. Issues related to venues, photographers, florists, and caterers were the top reasons for filing claims.

“However, with the average U.S. wedding costing nearly $30,000, couples need to consider how to mitigate the financial risks of planning a wedding.”

“No one likes to think of potential problems on what is supposed to be one of the best days of your life,” said Ed Charlebois, Vice President of Personal Insurance at Travelers. “However, with the average U.S. wedding costing nearly $30,000, couples need to consider how to mitigate the financial risks of planning a wedding.”

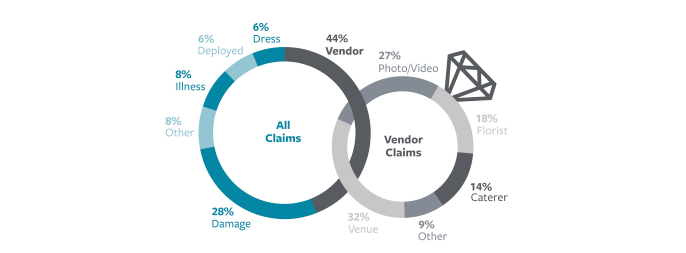

An analysis of Travelers’ wedding insurance claims from 2014 found that:

- Forty-four percent of claims involved vendors that were hired for the wedding and didn’t deliver as promised.

- Twenty-eight percent involved property damage to the venue that was related to the wedding.

- Eight percent of claims resulted from sickness and injury befalling the bride, groom, or key member of the bridal party leading to cancelation or postponement.

- Other issues, such as military duty/deployment and problems with bridal party attire, each accounted for six percent of claims, respectively.

The Wedding Protector Plan from Travelers can help couples protect themselves from financial losses caused by problems with vendors, special attire, special jewelry, photography and more. Couples can also purchase liability coverage as part of a wedding insurance policy to protect themselves from liability due to property damage and personal injuries to third parties at the event.

Some examples of losses wedding insurance covers, include: damage to or loss of the bride’s gown or groom’s tuxedo; deposits if a vendor goes out of business or simply does not show up; or loss of the rings before the event (within seven days of the event).

The Wedding Protector Plan can be purchased from an independent insurance agent or online. For more information, visitProtectMyWedding.com.

About Travelers

The Travelers Companies, Inc. (NYSE: TRV) is a leading provider of property casualty insurance for auto, home and business. A component of the Dow Jones Industrial Average, Travelers has approximately 30,000 employees and generated revenues of approximately $27 billion in 2014. For more information, visit www.travelers.com.